Clarity Money - Budget Manager

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | CLARITY MONEY, INC | iPhone, iPad, iPod |

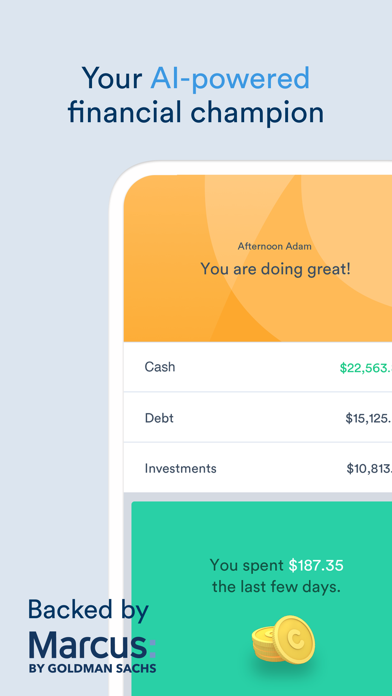

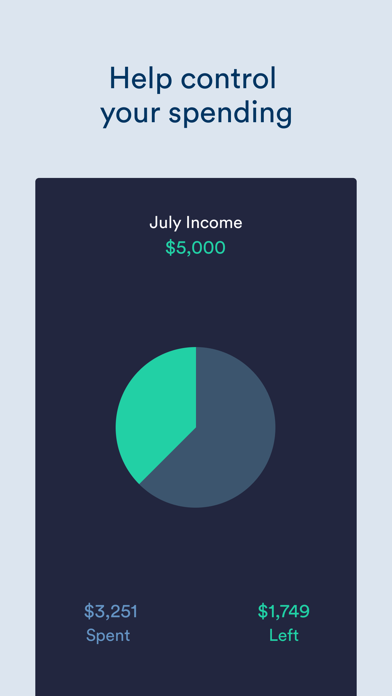

What else does Clarity Money do for you? Our free app will help you save money, plan your budget, track your spending, protect your credit score, lower your bills, and manage all of your accounts, in one place. Here’s what else Clarity can do for you:

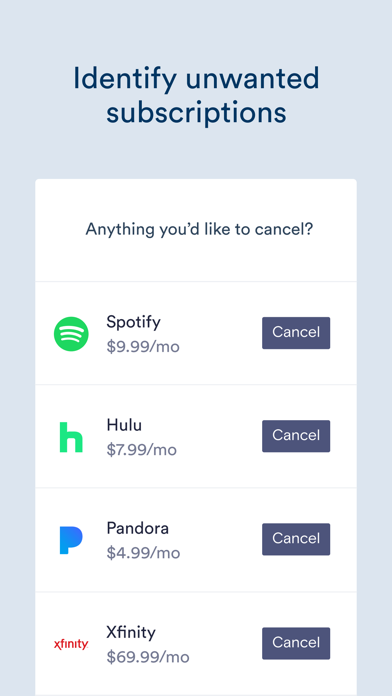

- Stop unwanted accounts and subscriptions from charging you

- Find you better credit card deals based on your spending habits

- Cancel and lower your bills

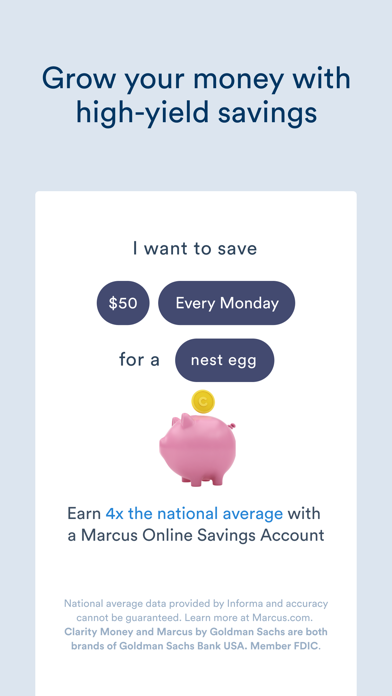

- Create a savings account

- Transfer money between your bank accounts

- Generate your credit score for free

Find out why TechCrunch, Mashable, and Business Insider are talking about Clarity:

“[Clarity] combines a number of the best features of existing money-management apps into a one-stop-shop. The app lets you cancel subscriptions, and suggests how to manage credit (by offering a credit card to consolidate debt and provide the best card for a particular type of consumer). The company also identifies bills that are negotiable and provides a service that automatically renegotiates for a lower rate. Finally, the Clarity Money app also lets users set up a savings account that will automatically withdraw money from a personal account.” - TechCrunch, 2017

“The iOS app is sort of a combination of Mint, which tracks your financial health, and Digit, which saves money in small increments. Clarity asks for your financial information, and from there tracks your spending and suggests ways to save. The app will look out for deals to lower your bills, suggest subscriptions you could cancel and help you save money for specific goals.” - Mashable, 2017

“It uses data science and machine learning to negotiate bills, create a savings account, find lower interest rate credit cards and/or personal loans, transfer money between accounts, and deliver actionable insights based on your spending patterns, credit score and credit cards.” - Business Insider, 2017

Clarity Money is your financial champion and advocate, watching your back and looking for ways to save you money while keeping you on budget and in control of your finances. Download Clarity Money today!

Reviews

Poor implementation

DanIsNotMyName

Great idea but... annual view doesn’t load, you can’t edit your monthly income when setting a budget. How can I trust you with my financial data if you can’t get the basic features right?

Very very close

NTxHog

I’ve tried them all, Mint, Prizm and the rest, and Clarity is the best. But it could be better. The first app to add the following features will rule the account management world: 1. Let me know how recently my accounts have been updated. I can’t tell if they were updated today or a week ago. 2. Allow the creation of more categories of accounts. For example, I would like to split Investment up into subcategories. Recommend the app but will be watching the others to see which comes up with new features

It can’t tell I’m in the US

Boss$$$$$&$:):&!3?&9

I tried to sign up and it keeps telling me “We’re only available in the US” I am very much in the US. I wanted to contact help and speak to someone, the only way to do that is through the app. Ridiculous.

Can’t link my bank account

Sortinousn

Wanted to use this app but my suntrust account won’t link. App just shows a spinner for 5 minutes and says it failed

Access an issue from the get-go

VenitaLynn

Decided to try an alternative to Mint. It went well for about a minute. Trying to add my first bank account, I received an error that in order to connect an account, I had to have the most recent version of the app. Went to App Store, no updates available. Bothered to update the OS on my phone, and check again, still no updates available. Opened the app to try one more time and received same error. Access issues from the start does not bode well for being any kind of improvement from Mint, and access problems are the reason I decided to try something else after years of using it. Not worth the trouble if they can’t get that right. ??♀️

Easy to use but some glitches

SR72019

The app is way easier to use than MINT but there are software glitches that keep my customized budget from saving.

Great UI but functionally is buggy

Xonstanin87

- on my fist login tried to restore password 3 times and the app says it sent it to my email but I never received it. - adding Citi bank timed out 2 times with a long spinning wheel - adding wells Fargo locked my bank access immediately after I entered the wrong answer for the security question very first time - adding discover i had to re-enter my security answer 3 times until it recognized it - didn’t find a way to rename bank accounts so ended up with 2 identical entries for USBank (mine and wife’s) - spending breakdown showed only last 2 month while transaction list is available back to dec 2018 - farmers insurance payment somehow landed to Grocery category Back to Mint. Will try it out again in 6mo...

Why weekly budget instead of monthly?

TinkeringTinker

Setting weekly budget makes sense to me in daily expenditures like groceries, meals, etc. But I would very much to like a monthly budget. Rent, utilities, and a lot of other things are billed monthly. It’s very inconvenient that I need to calculate them into weekly form.

My Financial Institution isnt on here

Austin_Barlow

I’ve been waiting months for them to add my bank. I’ve submitted my bank countless amount of times. Seems like a cool app but I cant even use it because they havent added my bank. At least fix the app so if you dont connect your bank you can use the app to help you with weekly bugeting.

Bank unlink

fffffields5

I’m very upset that my account has unlinked from my bank again. I would like to be able to access my money, if not I may have to take legal action.