Two best stock market simulator games for 2022

What is a stock market simulator game and why should you care?

Update 2024: Here is a very detailed comparison of the best stock market simulator apps.

Have you ever wanted to try trading stocks and test if you have what it takes to become a rich trader or investor?

Chances are you're not sure where to start and you're a bit afraid of losing your money.

In that case, you should probably consider using a stock market simulator game.

Stock market simulators let you practice trading without any investment and risk of losing your hard-earned money.

It's like a Monopoly game, but instead of properties, you are buying stocks of companies.

In a trading simulator, you usually get $100,000 - $1,000,000 of virtual money to buy or sell stocks with real-time prices.

Stock simulators are a great way to learn the basics of the stock market. You can safely learn how prices react to certain events, how to short sell a stock, how commissions work, etc.

You can also use a trading simulator to test strategies, stay updated about your favorite stocks, and dream a little bit about making huge returns on your virtual portfolio.

In this article, we will look at two best simulators, one aimed for day traders and the other - suited more for learning long-term investing.

Do you want to get wealthy in one year or in 20 years?

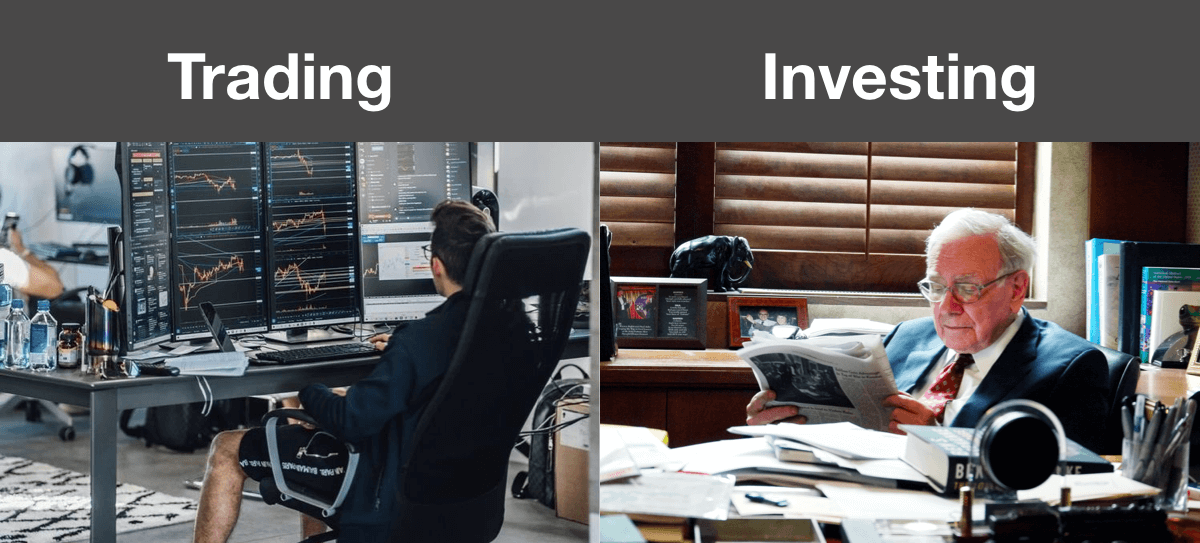

You probably know that there are two different approaches to making money in the stock market - trading and investing.

Before making any investments or starting to practice, you must decide what's your current aim and which approach is more appropriate for you.

1. Trading

Short-term traders hold their positions for minutes, hours, or a couple of days. The aim is to profit from short-term fluctuations of asset prices. A short-term trader doesn't care about the long-term success of the shares they pick. He can also short the stocks, meaning he can bet on the decrease of the stock prices.

Don't get too hyped, though. The statistics show that the majority of day traders lose their money.

How much money do the successful traders make on average? The few traders who manage to make consistent gains can make from 30% annually to 334% annually.

2. Investing

Long-term investing is more like watching the grass grow.

A typical long-term investor is ready to let his money sit and grow for 10-20 years. He doesn't stress about the short-term dips in the price. On the contrary - he buys some more stocks during the market dips.

Long-term investing generally has a significantly lower risk compared to day trading. Lower risk usually comes with lower potential profits, if we compare the top performers from the two groups.

How much money do the investors make? The average annual gains for long-term investors can vary from 7% to 35%. Slower but steadier.

P.S. Investors make money not only when they sell their assets at the end of the long waiting, but also from quarterly dividend payments. For example, Coca-Cola pays its shareholders around 2.81% annually.

What's the takeaway here?

These two are fundamentally different approaches. Thus, for practicing you also need different types of simulators.

Let's uncover the best platforms for learning the basics of both of these approaches.

Best stock market game application for learning day trading

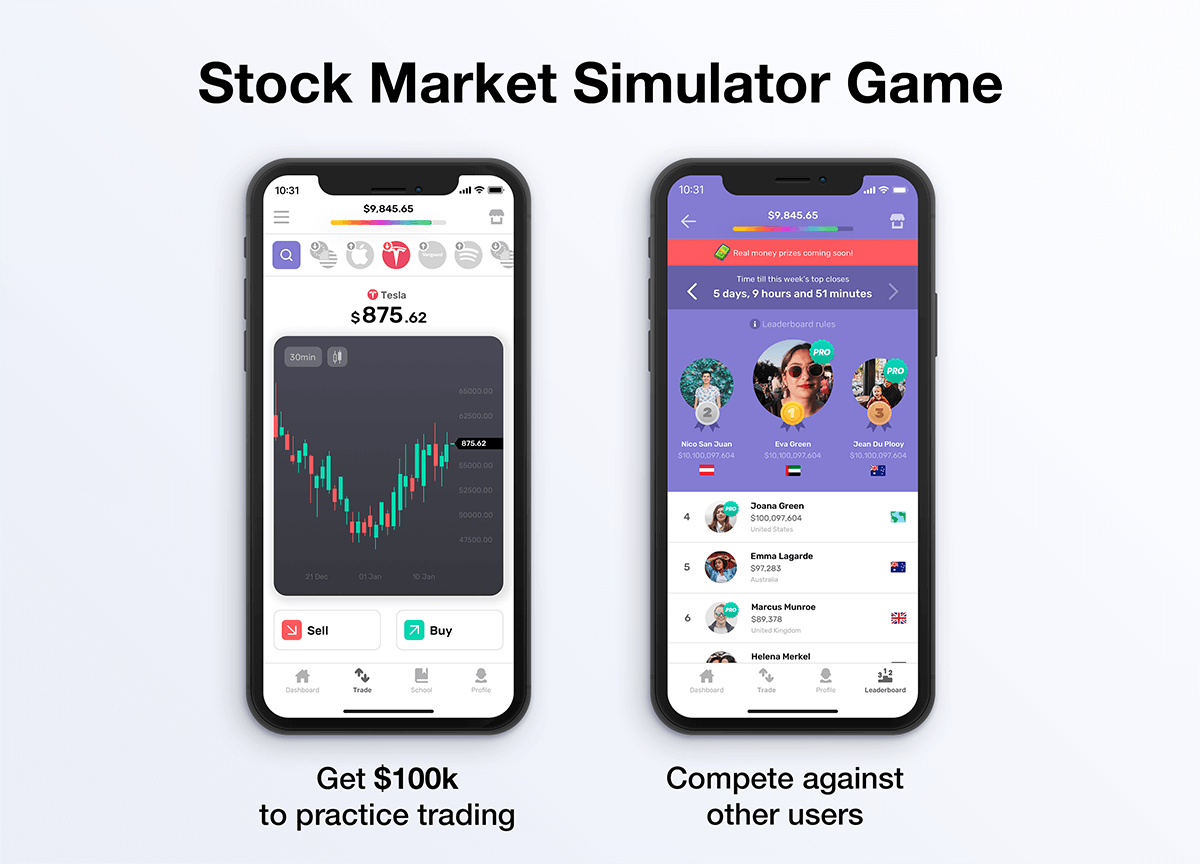

After testing more than 25 different stock simulators for mobile phones, our favorite app for learning day trading is Trading Simulator by Three Investeers which ticks most of the checkboxes.

Pros:

- Many simulators have delayed market data, but this one has real-time prices that update multiple times per second

- An active weekly leaderboard that makes it more fun and also boosts your motivation to learn and improve your results.

- Commission simulation included, so you don't get too many unpleasant surprises if you decide to start trading with real money later.

- Besides stocks, you can also try trading forex, crypto, gold, oil, and other assets.

- Great for beginners - the user interface is nice and clean and you are not overloaded with unnecessary clutter.

- Unlike many apps that have only line charts, this app also has candlestick charts that make it easier to spot price patterns.

Cons:

- Stop-Loss and Take-profit orders not available at the time of writing.

- You can only open one trade per asset at a time.

- Have to use other resources to get financial data about stocks.

Summary: With the Three Investeers stock market app you get the most important features for beginners in a pleasant and entertaining package.

You can download the app for free on iOS and Android.

Best stock simulator for learning long-term investing

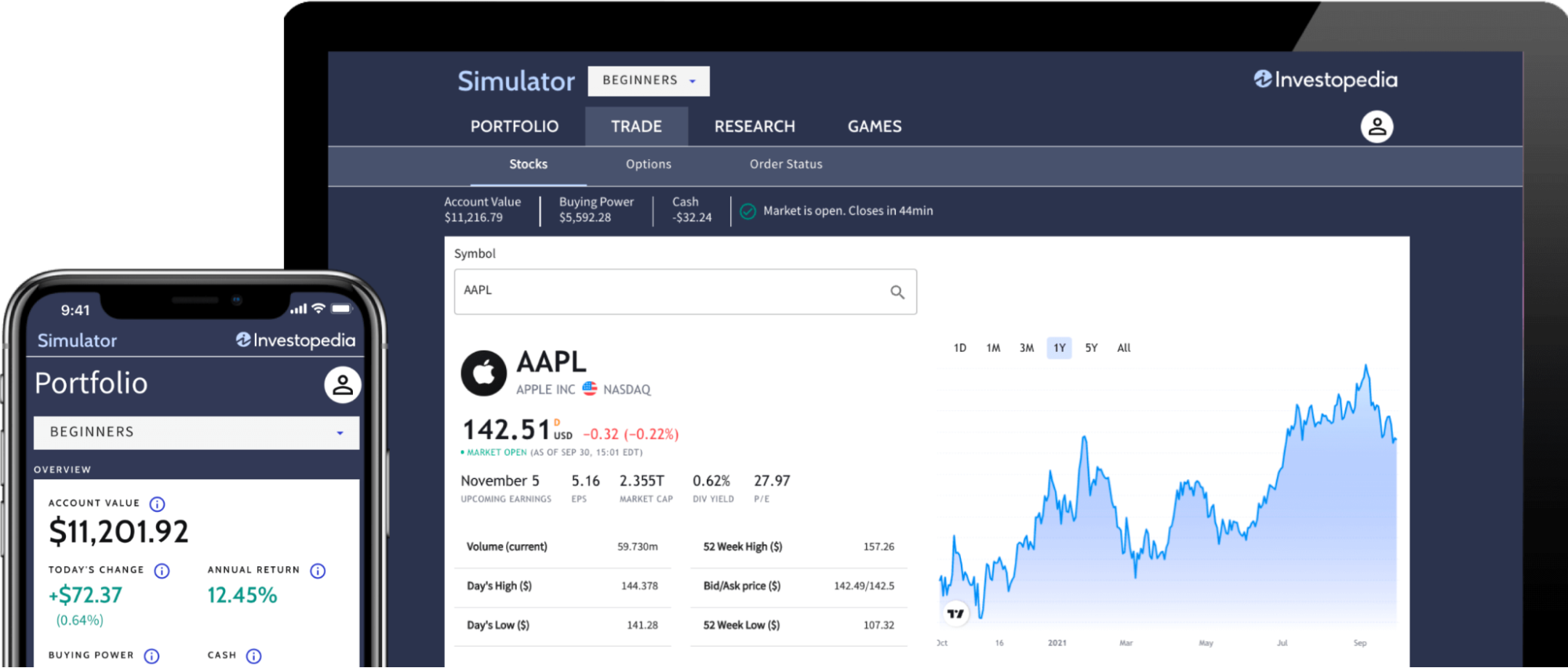

If you want to learn the basics of long-term investing, you can play around with one of the most popular web-based trading simulators - Investopedia Stock Market Simulator.

Pros:

- You can practice using different order types: Limit, Market and Stop limit.

- Research tools available (technical ratings, price to earnings ratio, etc.)

- You can create your virtual portfolio and also see how you compare against the overall market (S&P500)

Pros:

- Not real-time prices, instead you get 20min delayed prices. Not great, but fine for wannabe long-term investors.

- No mobile apps are available, so the experience on mobile is not excellent.

- Limited to just US stocks. No European or Asian stocks, cryptos, or currencies.

Summary: If you're a beginner who wants to learn how to create a portfolio that could make you a wealthy retirement, the simulator by Investopedia is a great choice.

Bottom line

Trading is a risky business. And nobody becomes super-successful right away. Most beginners lose their money if they jump straight into real money trading. Simulated trading is a great way to dip your toes into the stock market and practice trading without any risk.

However, you should keep in mind that trading with virtual money can create false expectations of your skills. Trading with real money has a different psychological effect. So you should not start trading with big bets right after a simulator. Instead, you should start with small investments that you can afford to lose.

Many of these stock market games are also suited for kids so check out the list if you have children interested in learning about stock market.