Till: Banking for Teens & Kids

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | Till Financial, inc. | iPhone, iPad, iPod |

Parents:

Get the guardrails and transparency you need to confidently move dollars you’re spending on behalf of your kids directly into their hands—all on the timeline you’re comfortable with and while they still have the support to correct mistakes. Here’s how:

- Set up your Till Family to gain one complete picture of your teens’ spending on their card and invite extended family members to join in support

- Tame chaotic asks for money with a simple dashboard that allows you to instantly push funds to teens’ Till accounts and card on your terms

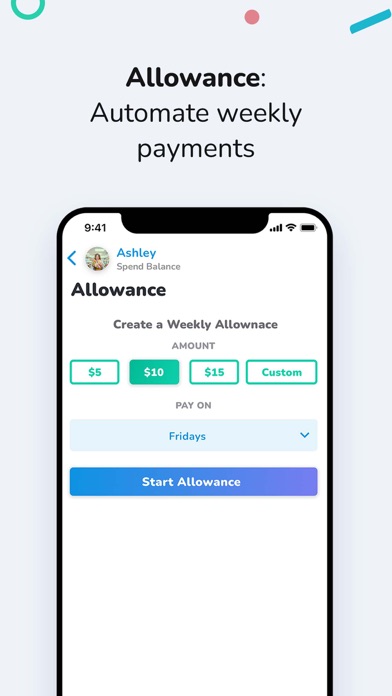

- Automatically transfer money for completed chores and schedule recurring allowances

- Instill accountability (and an understanding that money doesn’t grow on trees) with matching and interest contracts that reward thoughtful savings and goals

- Get everyone comfortable with teens spending more through goals for meaningful purchases

- Invite supporters (grandmas, aunts, uncles, etc) to contribute and celebrate success

- Raising kids is tough—enabling them to be responsible financial actors doesn't have to be

Teens:

Stop asking your parents to spend money for you and start spending it with your own card, with the support you need to do it well. Understand when to save and when to spend, all in preparation for the real world.

- Join your family on Till so you can request money in-app and gain independence in your spending

- Get your own debit card (accepted everywhere Visa card is and accessed through your phone) so you can stop asking for cash or your parents’ card every time you want to spend

- Receive money transfers as you complete chores (we call them Tasks)

- Earn trust as you show you can spend well

- Set goals for saving towards meaningful purchases

- Get contributions toward your big goals from grandma (vs that awkward reindeer sweater you will never wear)

*Smarter spender: noun - a young adult who can survive financially in the real world once they leave home. They:

- Have a healthy sense of what money is coming in and going out each month

- Can balance short term rewards with long-term goals

- Know why a credit score matters and how to improve theirs

- Have a healthy respect for but not fear of money

- Won’t come calling for money on a rainy day

Till banking products and services are provided by Coastal Community Bank, Member FDIC, pursuant to license by Visa USA Inc. Together, your Till Spend and Till Save Accounts are FDIC-insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC.