OptionPosition+

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | Peter Kramer | iPhone, iPad, iPod |

OptionPosition+ is a financial analysis App that estimates the value of a set of shares and put and call options for a particular stock. It allows the investor to explore various option hedging positions and create a portfolio that is sensitive to price and volatility fluctuations or that provides protection for various concerns. OptionPosition+ graphically illustrates the value of put protection, covered calls, call spreads, time spreads, delta neutral skew trades, iron condors, etc.. Examples of the use of OptionPosition to explore and display various hedging and speculative strategies are located at our website: www.OptionPosition.com.

OptionPosition+ comes with an initial one month subscription period that provides access to data on most stocks listed on the NYSE and NASDAQ and certain indexes (i.e. SPX, NDX, RUT, RUI, VIX). After this one month subscription period you may purchase an auto-renewing subscription through an In-App Purchase. (If you do not maintain a subscription you can only access stock and option data for AAPL.)

• Auto-renewable subscription

• 1 month ($2.99), 2 month ($4.99) and 3 month ($5.99) durations

• Your subscription will be charged to your iTunes account at confirmation of purchase and will automatically renew (at the duration selected) unless auto-renew is turned off at least 24 hours before the end of the current period.

• Current subscription may not be cancelled during the active subscription period; however, you can manage your subscription and/or turn off auto-renewal by visiting your iTunes Account Settings after purchase.

• Privacy policy and terms of use: https://sites.google.com/site/kramerkramersoftware/

OptionPosition+ Features:

• delayed stock and option prices for all available strike dates and strike prices (delay varies from 0 to 20 minutes)

• remembers 30 different portfolios each with 6 assets:

..........puts, calls, shares or child portfolios

......................child portfolios can have different underlying stock

......................child portfolios have correlated price

..........long, short any quantity

..........all listed strike dates

..........all listed strike prices

..........e-mail to anyone

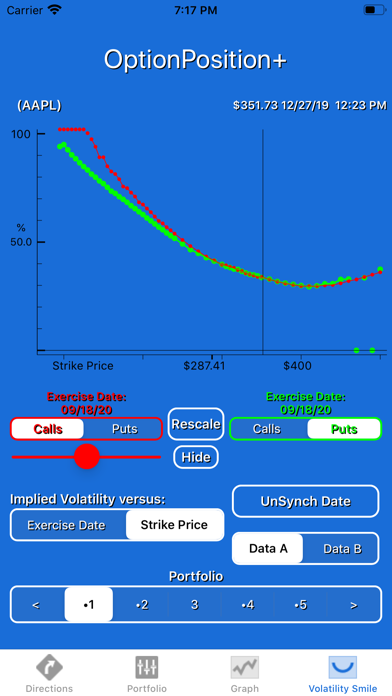

• Black-Scholes equation used to determine implied volatility and future value of put and call options

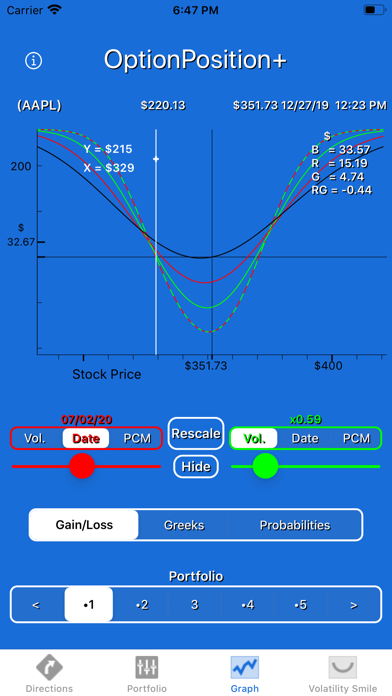

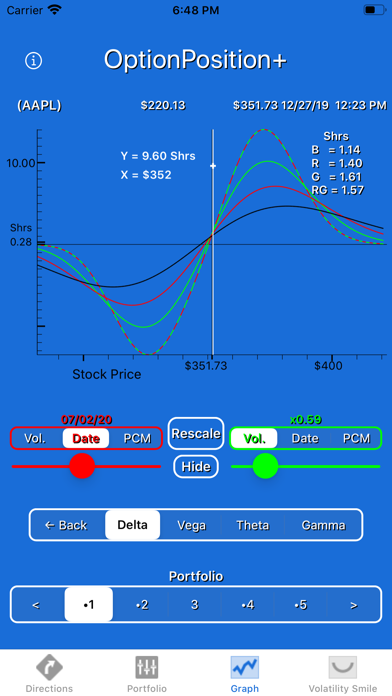

• graphically displays Gain/Loss, Delta, Vega, Theta or Gamma as a function of stock price:

..........now (see black lines below)

..........at any future date up to the earliest strike date (see red lines below)

..........at assumed higher or lower volatilities (see green lines below)

..........with a changing price correlation to child portfolios included as an item/hedge

• graphically displays the probability of future stock prices and the probability of future option portfolio Gains/Losses based on current put/call straddle prices

• scales on the graph are continuously adjustable with one and two finger moves – easily zoom in or out

• tap on the graph to show the X,Y value at a point and the value of the curves at that X value

• diagnostics table shows all Greeks and lets you easily create a Delta neutral portfolio

• 3 month US dollar LIBOR used for risk free interest rate

• incorporates predicted dividend payments into the Black-Scholes calculations without making a ‘fixed dividend rate’ error in Delta

Screen shots:

For an explanation of these option positions, and more, see our website www.OptionPosition.com. Screen shots shown below (for both iPhone and iPad):

1) Gain/Loss graph for an Iron Condor in AAPL

2) Assets (iPad includes Diagnostics) for the Iron Condor in AAPL

3) Vega graph for the Iron Condor in AAPL

4) Probability of the value of the Gain/Loss for the Iron Condor in AAPL

5) Gain/Loss for a Put Protection in SPY

Reviews

What I have been looking for

ThePostGuy

This is a really nice app. I have been looking for a way to model both open positions and what/if positions. Greeks track right along with my broker's software, and gives both a synopsis of the total position as well as each individual strike in that portfolio. Easy to project how changes in volatility and time will change the position. I have had a few questions, and each time the developer has gotten back with me quickly. Haven't found any other app that can do what this one does - and I am glad this one is here as I can now leave my laptop at home. I am several days into using this and am comfortable giving it five stars.

Great tool for option traders

Toby F.

This is a great tool for planning option strategies and then keeping track of P&L and sensitivities on executed positions. The fact that it automatically downloads market data is a huge bonus. The subscription price is VERY reasonable for anyone who actually trades options. Many retail brokerages charge much more just to execute a single option trade let alone the cost of crossing the spread.

Great for beginners

Rasantov

This app helps me make decisions on what option strategy to follow. Its my best buy in the app store!

Very useful when I did not want to go into my full app

Dr.emg

This is the best option analytic app for options I have used to date. The calcs are crisp, however the chart seems to display the inverse graph for a short put/short call pair for the same expiration.

Excellent app!

Long time trader

I think it's worth the money. This is actually useful tool. Thanks a lot.

responsive developer

btoma33

The developer is focused on meeting and exceeding customer expectations.

Excellent App. Would even pay for.

Remember the 5th of Nov

Great support by creator. Keep up the good work. !