MileGo - Mileage Tracker & Log

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | JL Creations group llc | iPhone, iPad |

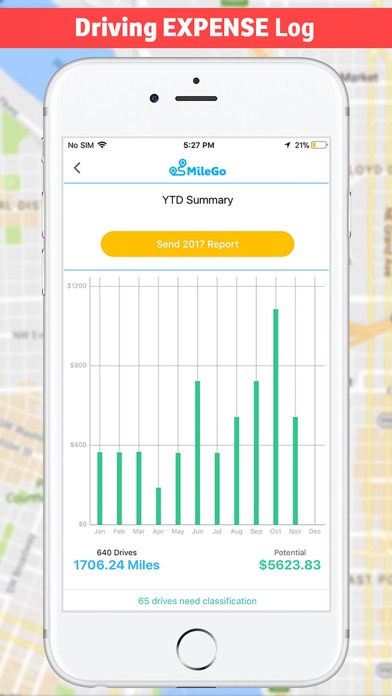

Each mile you drive for work or business is worth 53.5 cents in standard mileage tax deductions or expense reimbursements.

If you drive 1,000 miles for work, you can claim a mileage deduction of $535 (1,000 x 53.5 cents). If you drive, 10,000 miles, you can claim $5,350 in mileage deductions.

MileGo records and keeps track of miles travelled for business purposes, such as distance travelled to visit clients or attend business meetings, and can even be used for personal mile logs. At the start of each ride, simply select the type of trip you’re making, business or personal, and then hit the road. Let MileGo take care of the rest!

Monthly reports will be available for download on the MileGo website, perfect for easy analysis and audit support.

Business Mileage Tracker, Enjoy More Things in Life !

MileGo Key Features:

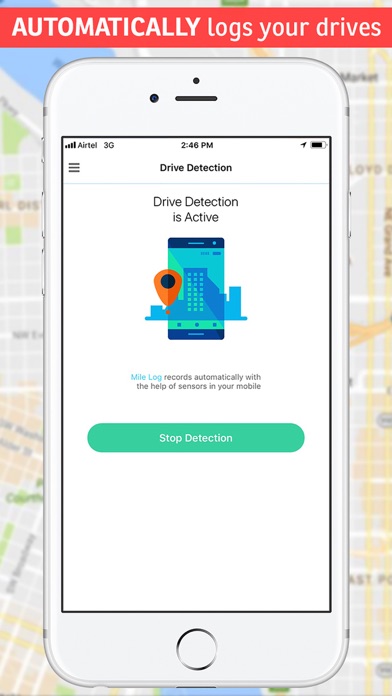

• Automatically track & notification every trip

• Sort by different ride purpose/users could customize

• Show date/location for each ride

• Store your monthly ride history

• Export email in easy summaries

• Capture rides in miles or kilometers

• Available in English and Chinese

40 Free Drives

Upgrade to unlimited drives for $5.99/month recurring or $59.99/year recurring.

Subscription Details

• Payment will be charged to your iTunes account at confirmation of purchase

• Subscription automatically renews unless the auto-renew is turned off at least 24-hours before the end of the current period

• Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user's account settings after purchase

• Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable

Learn more

• Help Center: http://www.milegoapp.com/support/

• Website: http://www.milegoapp.com/

• Terms of Service: http://www.milegoapp.com/terms-conditions/

• Privacy & Cookies: http://www.milegoapp.com/privacy-policy/

Battery Consumption

Continued use of GPS running in the background can dramatically decrease battery life. MileGo has been designed to limit iOS GPS usage and as a result uses a nominal amount of battery power.

Recommend charging the device while driving to extend battery power and low power mode.

Reviews

Owner

Kylezhihu

Best mile tracking for business tax deduction I've ever used! User friendly and easy to use UI

Great App! Super easy to use

Jcutiz

Downloaded a couple of diff mile tracking app. And so far, this one I have not deleted off my phone. It's very easy to use. Clean. Simple. Straight forward. I just love it! N I love seeing the money amount go up. N how accurate it tracks my drive! ⭐️⭐️⭐️⭐️⭐️

Ryan.

BYD2017

Best mileage recording app ever used. Simple and clean. Can't wait to share with my friends and co-workers

Great app!

Zhiliang hu

This made my life so much easier. Instead of using pen and paper for record, now I can use this all to track all the mileages for tax deduction! Definitely recommended!

impressive

lunarbest1

This is the easiest mileage log I have ever used. The ability to store and reuse locations and activities makes it easy to quick track usage on the fly. Nice job guys!

it's nice

Hirsoshita1

Intuitive and useful. Works well with plenty of options for tracking my mileage monthly as well as for each job.