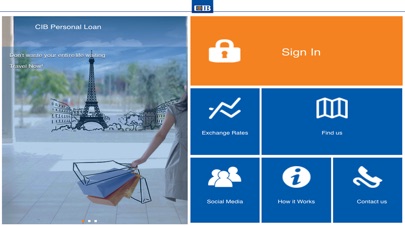

CIB Mobile Banking (Egypt)

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | Commercial International Bank (Egypt) S.A.E. | iPhone, iPad, iPod |

CIB app is free to download, however standard wireless carrier data rates may apply.

Getting Started

You need first to download and install the CIB Mobile Banking app on your mobile device.

Next, if you are already registered to CIB Internet Banking, login using the same username and password. It only takes a few minutes! If you do not have a CIB account, you can still use the application to locate the nearest CIB Branch, ATM and Merchant using the hi-tech augmented reality feature, contact CIB through e-mail or Call Center and view CIB foreign exchange rates.

Now Your Bank is in Your Pocket

Get quick, secure and easy access to fulfill all your daily banking needs and:

- View balances of your accounts, credit cards, loans, certificates and time deposits.

- Transfer money between your own CIB accounts in same or cross currency.

Settle your own CIB credit card or other CIB credit cards.

- Transfer to another CIB account using the same currency or foreign currency.

- Transfer to accounts outside CIB.

- Request a new chequebook.

- Stop lost/stolen credit card.

- Dispute credit card transaction.

- Change limits of supplementary card.

- Send inquiries, suggestions and complaints.

Legal

All transfers to own or other accounts inside or outside CIB, including settlement of non-CIB credit cards, require the use of OTP (“One Time Password”) token, in accordance with the regulations of the Central Bank of Egypt (“CBE”). The OTP token is an independent service that adds a higher level of identification and security and should be requested from CIB, as it is not included in this application. These transactions also require setting up a Beneficiary, which must be done through the Internet Banking.

By downloading the CIB Mobile Banking application or setting up your device to download it automatically, you agree to the installation of this application, its future updates and upgrades. You can withdraw your consent at any time by deleting the application.

Security

CIB holds no responsibility when using the application on any device or operating system that has been modified outside the mobile device or operating system vendor supported or warranted configurations. This includes devices that are, for an example, “jail-broken” or “rooted”.

Contact Us

If you need help, please call CIB Call Center 19666, International number (00202) 19666 or email: [email protected]

Please make sure you read and understand CIB Mobile Banking terms and conditions published on CIB website www.cibeg.com before you download the app.