BHIM – Making India Cashless

| Category | Price | Seller | Device |

|---|---|---|---|

| Finance | Free | National Payments Corporation of India | iPhone, iPad, iPod |

What can I do with BHIM?

BHIM works on Unified Payments Interface (UPI), which is a revolutionary payments platform. The features of BHIM are as follows:-

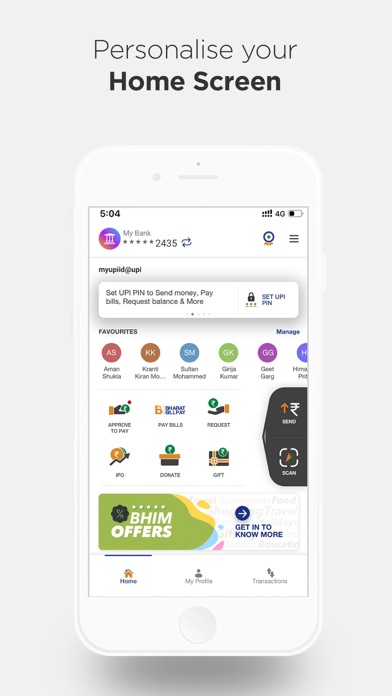

Access all bank accounts in one app

Pay for friends & relatives using their mobile number. (Provided they are on BHIM/UPI)

Pay to any user using any UPI application.

Shop online and checkout using “Pay by UPI/BHIM” for a quick and seamless experience.

Request money from any UPI user.

Scan a QR and pay on the fly.

Check account balance and pay via Aadhaar number.

Set Payment Reminders.

Split bill among friends and family.

Introducing Payment Rewards on BHIM

For New Users: Get ₹51 cashback on your first Payment on BHIM! *

For Existing Users: Get up to ₹750 / Month.*

*TnC apply

What is new about the BHIM App?

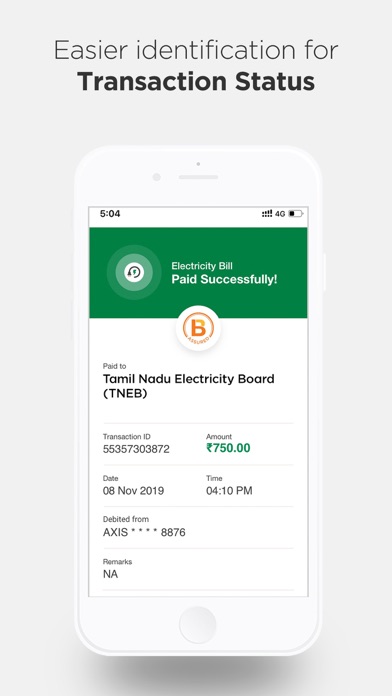

Be it online gas bill payment, water bill payment, or online mobile recharge, you can do everything through your BHIM app. You can also save your bills and pay bills every month without any hassle.

How does it work?

Register your bank account with BHIM, & set a UPI PIN for the bank account. Your mobile number is your Payment Address, & you can simply start transacting. Yes! It is that simple.

How to Transfer Money Online?

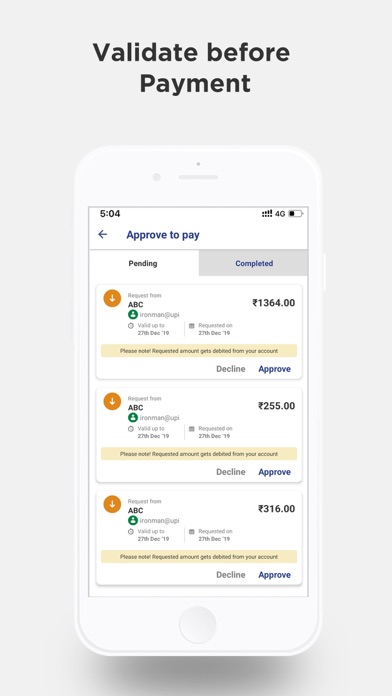

Make Cashless Payments or receive money from friends, family, and customers through a mobile number or payment address. Instant Money Transfer can also be made to an unregistered user using Mobile number, Account number +IFSC and Aadhaar Number. You can also collect money by sending a request and reverse payments instantly if required.

Check Balance:

You can check your bank balance and transactions details on the go.

Custom Payment Address:

You can create a custom digital payment address in addition to your phone number.

QR Code:

Now scan QR codes without logging into the app. Merchants can easily print their QR Code for display.

Block/ Spam:

You can Block/Spam users who are sending you to collect requests from illicit sources.

Pay using Aadhaar:

Make seamless transactions using Aadhaar number.

Split bills among BHIM users:

Now you can split bills and expenses among friends, family and also user in any app using UPI.

Set Payment Reminders:

You can set payment reminders for your recurring payments, so you don’t miss out on them.

Note: If you have accounts in the following five associate banks SBH, SBBJ, SBM, SBP & SBT please choose SBI from the list of banks as they have merged with SBI.

Requirements:

Before you register on the app, please ensure the following:

• You have a valid Debit Card for your account

• You have linked your Mobile Number with your Account

• Your registered mobile no. is present in the same device as the BHIM app

• You have registered your account for Internet/Mobile Banking

Supported Banks:

Visit our website https://www.npci.org.in/bhim-live-members to find out if your bank is live on BHIM

More about BHIM:-

13 languages supported on BHIM (Assamese, Bengali, English, Gujarati, Hindi, Kannada, Malayalam, Marathi, Punjabi, Tamil, Telugu, Odia, and Urdu.)

Transaction limit is Rs 20,000 per transaction and Rs. 40,000 per day (for 1 bank account)

Terms & Conditions:- https://www.bhimupi.org.in/terms-conditions

All-State bank accounts (SBH, SBBJ, SBP, and SBT) are merged with SBI. If you have an account with any of them, please select SBI as your bank

For more information, visit https://www.bhimupi.org.in/